Bitcoin’s Bullish Force Hits Fever Pitch As Options Open Interest Surpasses 1B For First Time In History

Bitcoin’s Bullish Force Hits Fever Pitch As Options Open Interest Surpasses $1B For First Time In History

By Brenda Ngari – May 8, 2020

Since BTC’s incredible rebound from the Black Thursday market rout in March, the pioneer cryptocurrency has been incredibly bullish. Bitcoin’s recent rally has ignited new hopes for a full-flown rally just in time for the halving slated for Tuesday.

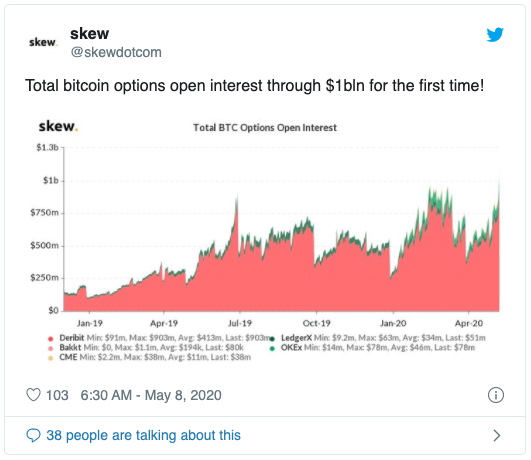

Besides the ongoing rally, the bitcoin options market is booming. According to data, the total options open interest recently crossed the $1 billion mark for the very first time in history.

Total Bitcoin Options Open Interest Reach $1 Billion

It’s an open secret that bitcoin (BTC) has been breaking records this week. Just days ago, the top crypto’s difficulty and hash rate hit fresh all-time highs ahead of the block halving event.

The upcoming halving -which will see miners’ rewards reduced from the current 12.5 BTC to 6.25 BTC- is undoubtedly the hottest topic in the cryptosphere right now. This event happens every four years and was designed to keep a lid on BTC’s inflation. Market pundits have indicated time and again that the event has always preceded a monstrous rally. It appears that all market participants are taking note of it.

Incredibly, on May 7, bitcoin broke another record -this time, in the options market. According to data relayed by crypto derivatives monitoring firm Skew, the total bitcoin options open interest hit $1 billion.

This is the first time the combined volume of bitcoin options volume from Deribit, LedgerX, CME, and Bakkt broke above $1 billion. Deribit exchange took the lion’s share with a $903 million volume, representing almost 90% of the total options positions. OKEx and LedgerX took the second and third largest share of the open interest for bitcoin options, with a total of $78 million and $51 million respectively.

The growth in the total options open interest is a notable spike from the roughly $400 million options trading volume seen during the mid-March debacle.

Can BTC Successfully Conquer The Elusive $10K Level At Halving?

The increase in open interest offers some hope of BTC firmly reclaiming the $10,000 psychological level. Skew noted yesterday that the options volume for CME, in particular, are soaring. This means that more investors are participating in the bitcoin market.

Moreover, bitcoin recently zipped past $10,000, adding to the bullish sentiments in the cryptocurrency market. Most people are expecting the top crypto to demolish the $10k hurdle in the near term.

Meanwhile, should a pullback happen in the short-term, analyst Josh Rager expects the $9,500 level to act as sturdy support. The next resistance lies at $10,369. Clearing this level should open the door for the bitcoin price to push even higher.

DISCLAIMER

The views expressed in the article are wholly those of the author and do not represent those of, nor should they be attributed to, ZyCrypto. This article is not meant to give financial advice. Please carry out your own research before investing in any of the various cryptocurrencies available.

The original article written by Brenda Ngari and posted on ZyCrypto.com.

Article reposted on Markethive by Jeffrey Sloe

Visit MarketHive to learn more: http://markethive.com/jeffreysloe