Cryptocurrency Called Omicron Is Up 137

A Cryptocurrency Called Omicron Is Up 137% Since WHO Named New COVID-19 Variant

Cryptocurrency 'Omicron' was named weeks before the new COVID strain.

By Andrew Hayward 3 min read • Nov 28, 2021

In brief

- Omicron is up 137% in the last 24 hours.

- The token is backed by a basket of assets, including USDC.

- It's a fork of DeFi project OlympusDAO.

Markets may have crashed after Omicron, a new coronavirus “variant of concern”, emerged earlier this week and started spreading to a country near you.

But. Sigh. That didn’t, urgh, stop one coin, Omicron, from, ð , spreading. Yup, one of the best ways to profit from human misery this week was to invest in a cryptocurrency project that’s most recognizable for bearing the name of the latest strain of Covid-19.

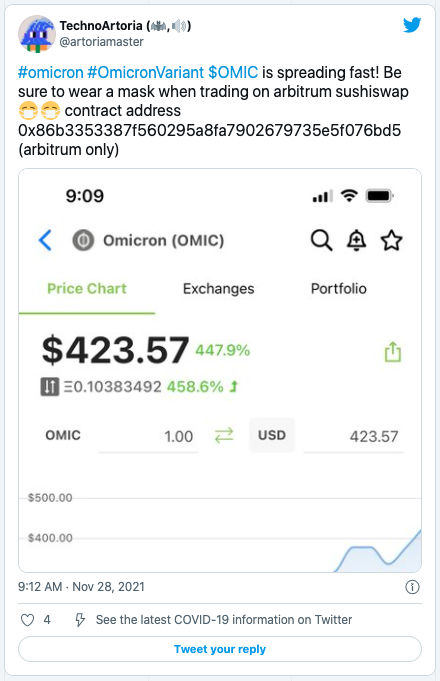

A single Omicron token is now worth $404, up 137% in the past 24 hours and 735% compared to its all-time low on November 17. Trading data for the coin on CoinGecko starts on November 8. A poll on CoinGecko says that 69% of users feel good about the coin.

The market for Omicron is very small. Omicron traded just $389,181 in the past 24 hours and its market cap is “?” on CoinGecko. The token trades solely on Arbitrum One via SushiSwap.

The Omicron token powers a decentralized reserve currency protocol on the Arbitrum Network. The token is backed by a basket of assets, including USDC and liquidity provider tokens tied to MIM. It’s a fork of OlympusDAO, a novel DeFi project that backs its token through primitive blockchain bonds.

The main way to keep pumping the price of the Omicron token and its yield farm is by ‘supply growth’, and the whole thing falls apart if people stop investing money. So far, $671,081 has been deposited within its protocols, which leads to breathless projected annual yields of 70,377% for stakers (unless the developers pull the plug or people stop investing money or if any of the countless reasons that commonly prompt the collapse of yield farms materialize).

So it’s just another bond-based yield farm, one which happens to have the same name as the new Covid-19 variant, which although timely is simply named after the fifteenth letter of the Greek alphabet.

The crypto project makes no mention of the virus in its documentation and its first Discord announcement was sent at the beginning of the month, several weeks before the latest variant was named Omicron by the World Health Organization. That said, virus talk is rife on the project’s 500-strong Discord chat and on Twitter.

It should be noted that this coin, whose ticker is OMIC, isn’t the first Omicron coin. That goes to another coin, which goes by the ticker name OMC on CoinMarketCap and doesn’t trade on any popular markets.

The original Omicron first surfaced on August 31, 2016 on the Bitcoin Talk forum as a “dividend-issuing currency.” The project claimed to have raised 121 Bitcoin, now worth $6.5 million (before the Omicron virus crashed the markets this week, its raise would have been worth a helluva lot more). After a handful of dividend payouts, the project petered out.

If only the project’s creators could have predicted how important the name ‘Omicron’ would be just five years later. At least they predicted that the whole crypto thing would blow up.

DISCLAIMER

THE VIEWS AND OPINIONS EXPRESSED BY THE AUTHOR ARE FOR INFORMATIONAL PURPOSES ONLY AND DO NOT CONSTITUTE FINANCIAL, INVESTMENT, OR OTHER ADVICE.

Original article posted on the Decrypt.co site, by Decrypt Staff.

Article re-posted on Markethive by Jeffrey Sloe

Visit MarketHive to learn more: http://markethive.com/jeffreysloe