Ethereum (ETH) has a 19% Probability of hitting $6k

Ethereum (ETH) has a 19% Probability of hitting $6k by End of 2021

JOHN P. NJUI • ETHEREUM (ETH) NEWS • MAY 8, 2021

- Ethereum has a 19% chance of hitting $6k by the end of 2021

- Demand for Ethereum has led VanEck to apply for an ETH ETF with the SEC

- Ethereum markets have had record activity this week with OI on Futures hitting $10 Billion

- Ethereum on exchanges continue to drop and could signal a new round of growth by ETH

The second most valuable digital asset of Ethereum has a 19% chance of hitting $6k by the end of 2021. The probability of Ethereum hitting this milestone was shared by the team at Unfolded through the following tweet and accompanying chart.

VanEck Files for an Ethereum ETF with the SEC

Demand for Ethereum in the crypto and traditional markets has led to the asset management firm of VanEck filing for an ETH ETF with the SEC.

According to the filing by VanEck to the SEC, the proposed Ethereum exchange-traded fund will not provide direct purchasing and selling of ETH. Instead, the ETF will offer shares that will be traded on the Cboe BZX Exchange. The shares will be backed by Ethereum and their value based on the reported MVIS CryptoCompare Ethereum Benchmark rate.

The SEC is yet to approve any crypto-based ETF in the United States. In addition, the regulatory agency still has several pending Bitcoin ETF applications. Therefore, the chances of an Ethereum ETF being approved immediately are considerably low.

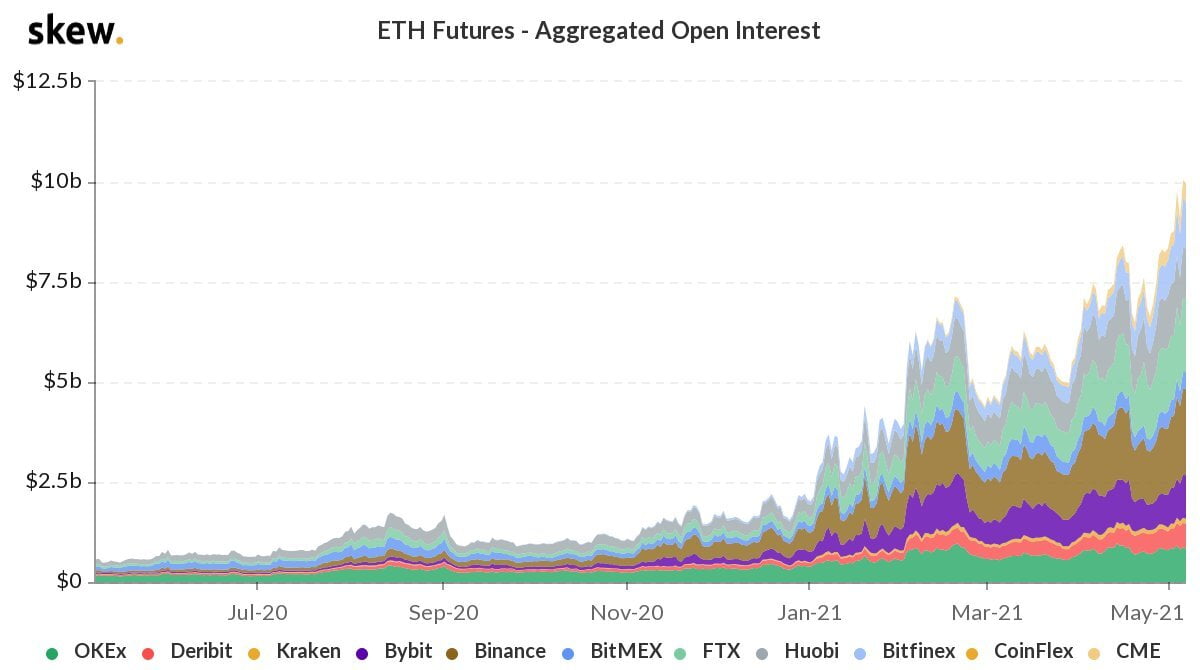

Ethereum Futures Open Interest Hits $10 Billion

In terms of trading activity, the ETH markets continue to break records since the digital asset broke the $3k ceiling with the new month of May. According to data from Skew, total open interest on Ethereum futures has hit $10 billion for the first time as demonstrated through the following chart.

Ethereum Held on Exchanges Continues to Drop

At the same time, on-chain metrics continue to indicate that investors and holders of Ethereum are continually moving their ETH out of exchanges. Such activity is causing a supply shortage of Ethereum and will probably result in a knee-jerk reaction in the form of a price increment. This scenario was forecasted by crypto community member @JA_Maartun as seen in the following screenshot.

Original article posted on the EthereumWorldNews.com site, by John P. Njui.

Article re-posted on Markethive by Jeffrey Sloe