High Revenue From ETH Fees is Attracting Miners to Join Ethereum

High Revenue From ETH Fees is Attracting Miners to Join Ethereum

John P. Njui • DEFI • ETHEREUM (ETH) NEWS • SEPTEMBER 29, 2020

Quick summary:

- The popularity of DeFi and Decentralized Exchanges since June 2020, has led to Ethereum experiencing high ETH fees

- Miners are reaping big from these Ethereum transactions thus attracting new miners to the network

- The value of Ethereum will continue to benefit positively from the demand to pay transactions with ETH

The team at Coinmetrics has released this week's SOTN (State of The Network) report in which they highlight that the rise of DeFi has increased Ethereum's hash rate towards all-time highs. Furthermore, high ETH fees paid by users to confirm transactions on the Ethereum network are incentivizing more miners to join the network.

The team at Coinmetrics shared their observation of the Ethereum network via the following statement.

The rise of DeFi has pushed Ethereum hash rate towards all-time highs.

With transaction fees surging, more miners are incentivized to join the network.

High ETH Fees Make Ethereum More Secure

Additionally, the high ETH fees paid out to miners mean that they are further incentivized to secure the network which is good for the long-term well-being of the Ethereum blockchain.

The fees are ultimately paid to miners, so high total fees create more incentive to secure the Ethereum blockchain.

Ethereum miner revenue hit new highs over the summer due to the rise in fees, and as a result Ethereum hash rate is climbing towards all-time highs.

This is a good sign for Ethereum, as network security is critical for the long-term health and success of the blockchain.

Ethereum’s Price To Benefit from Demand for ETH to Pay Fees

As earlier mentioned, the quick rise of Decentralized Finance projects such as UniSwap (UNI), Yearn Finance (YFI) and more, has caused a similar demand for ETH to power transactions on these protocols. The demand for ETH has had a positive effect on the price of Ethereum.

The team at Coinmetrics has captured this fact and explained that it all begun with Yearn Finance.

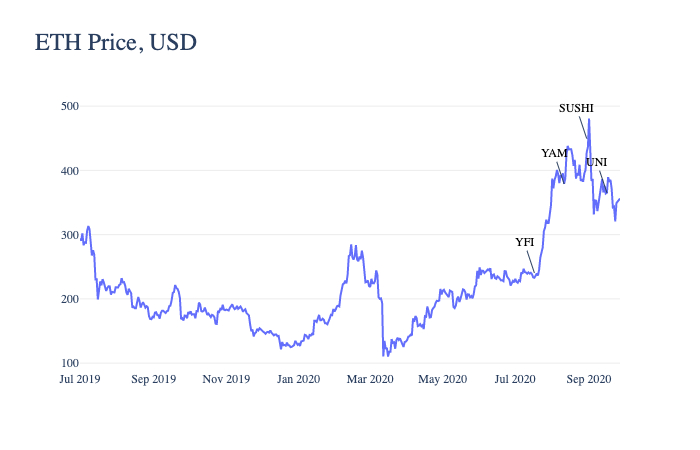

The rise of DeFi has brought on a wave of new tokens including some breakouts. The start of ETH’s summer bull run coincided with the launch of yearn.finance’s governance token YFI.

Furthermore, the report by Coinmetrics provided the following chart highlighting the launch of each DeFi project and its effect on the price of Ethereum.

Chart courtesy of Coinmetrics.io (Click image for larger view)

Original article posted on the EthereumWorldNews.com site, by John P. Njui.

Article re-posted on Markethive by Jeffrey Sloe

Visit MarketHive to learn more: http://markethive.com/jeffreysloe