Bitcoin Mining Difficulty Hash Rate Surge As BTC Holds Above 8000: What Death Spiral?

Bitcoin Mining Difficulty, Hash Rate Surge As BTC Holds Above $8,000: What Death Spiral?

Bitcoin Fundamentals Booming

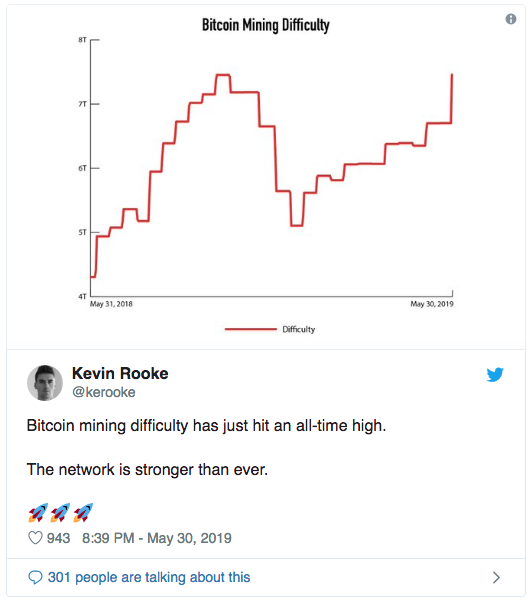

With BTC moving above $8,000, the fundamentals of the Bitcoin blockchain have also surged. As pointed out by industry researcher Kevin Rooke, Bitcoin’s mining difficulty has reached an all-time high of 7.46 trillion. The thing is, we’re still down by around 55% from BTC’s all-time high of $20,000, and public awareness of the cryptocurrency space is still much lower than it was back in 2017. For those unaware, mining difficulty refers to how hard miners need to work to solve one block.

This comes after mainstream media, namely this one report from MarketWatch, called for a “death spiral,” whereas miners would fold en-masse, sending BTC into the ether. This booming difficultly figure shows that this isn’t the case. As Andreas Antonopoulos, a legendary Greek-British Bitcoin educator, once explained:

“If [miners] wait until the difficulty retargets and the difficulty becomes less, then each miner who waits makes more profit because in the new scheme they have a greater percentage of the mining power than they did before. Let’s say if the mining power drops by 50%, the miners who stick around and wait for the difficulty to retarget are now twice as profitable after the retargeting.”

This is just the start though. Bitcoin’s hash rate has neared an all-time high, reaching 58 million terahashes per second this week. And also, the number of transactions being made with BTC have skyrocketed.

Market Infrastructure Strengthening Too

Not only are on-chain fundamentals extremely strong, but Bitcoin’s underlying market infrastructure too. Over the past few months, the market has seen a massive uptick in interest from institutions and corporations, most of which are looking to solidify this market is something that is here to stay.

This strong infrastructure is what some, like BitPay’s Sonny Singh, believe is what is behind the recent Bitcoin run, and why the ongoing bull market is likely just getting started. Per previous reports from Ethereum World News, this surge both in public awareness and in the press has much to do fundamentals. He explains that while 2017’s boom and 2018’s massive downturn was driven by hysteria and “momentum”, Bitcoin’s jump from $3,200 to $8,000+ is actually backed by infrastructural developments. The Bitpay C-suite member names the following developments:

- JP Morgan’s JPM Coin: Earlier this year, the banking giant launched its own cryptocurrency on Quorum, a private version of the Ethereum blockchain meant for more enterprise-specific tasks. JP Morgan has been using the digital asset as a way to transfer value inter-bank but intends to allow JPM Coin to see use in brick and mortar/online stores in the future. While JPM Coin is incompatible with Bitcoin, analysts suggest it will warm the public up to the idea of cryptocurrency.

- AT&T Accepts Bitcoin: Announced last Thursday, AT&T, a Texas-based American technology giant valued at $234 billion, will be accepting Bitcoin payments for its services through BitPay. Per a press release, AT&T is now the first “major U.S. mobile carrier” to provide its millions of customers with the ability to purchase services for cryptocurrency. This doesn’t mean that the firm is accumulating BTC per se, but it does show that AT&T acknowledges BTC as a viable medium of exchange.

- Square’s Cash Offering BTC: Although Square’s Cash App has been offering Bitcoin purchases and sells for its clientele since the peak of 2018’s boom, the company has continued to sell more and more BTC quarter-over-quarter. What’s more, Cash is continually near the top of the U.S. App Store, and the Bitcoin service is built right in, thereby increasing public awareness of Bitcoin greatly.

- Fidelity Investments Offering Bitcoin Custody, Trade Execution: Fidelity Investments, one of the world’s largest asset managers, has begun to offer an institutional-centric cryptocurrency custody and trade execution service for beta testers in its 20,000-odd non-retail clients.

Singh notes that these underlying shifts in cryptocurrency infrastructure confirm the validity of this asset class, and “is making people really excited, as is the light at the end of the tunnel for use cases.” He concludes with the idea that $9,000 is just the tip of the iceberg for Bitcoin, looking to the fact that many cryptocurrency projects from big-name corporations have yet to launch, or haven’t even been announced yet.

Original article written by Nick Chong and posted on the EthereumWorldNews.com site.

Article posted on Markethive by Jeffrey Sloe

Visit MarketHive to learn more: http://markethive.com/jeffreysloe