Coinbase: Global Market Uncertainty Drives Demand for Stablecoins

Coinbase: Global Market Uncertainty Drives Demand for Stablecoins

By Jeff Fawkes – April 22, 2020

Coinbase claims that global market uncertainty creates the demand for stablecoins. The on-chain transfer activity and the market cap of stablecoins keep growing. The blog post defines two most important stablecoins use cases. The first one is to be a safe haven in the days of overall volatility. And the second one is to enable fast cross-exchange payments.

Analyst Mike Co from Coinbase says that stablecoins are on the grand rise. Global commerce may soon demand a stablecoin economy to step in. He points on the JPMorgan’s pilot project called ‘JPM Coin’. People developing JPM are sure that instant cross-border payments on a blockchain will improve institutions.

Daily Active Addresses Rise for Stablecoins and DeFi

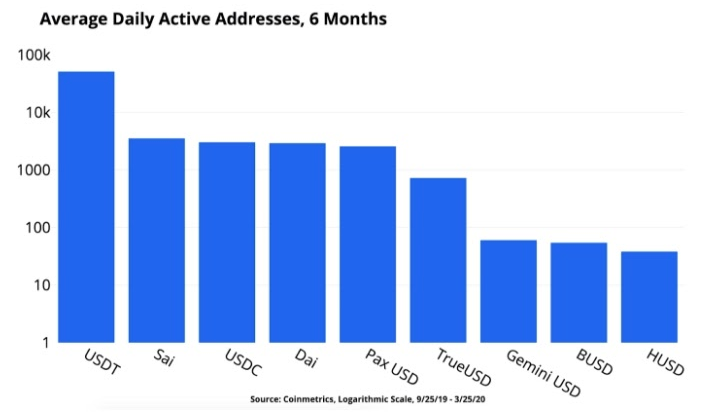

Per the analyst, the increase in daily active addresses means stablecoins gain more adoption. The graphs show USDT is the leader. It has more than 50,000 average daily active addresses. While Sai, USDC, Dai and Pax USD have up to 3,000 of them each. TrueUSD has around 1,000 of such addresses. And Gemini Dollar, BUSD and HUSD share the last positions with less than 100 addresses per day.

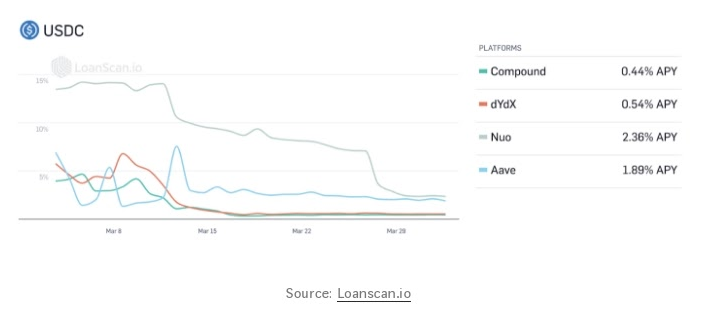

The study features the new iteration of the crypto game called ‘DeFi’. The Decentralized Finance sector is making sure that you can lend, borrow, or use stablecoins as collateral. Such actions are possible via things like Compound, Nuo, dYdX, and Aave. Working via smart contracts, they offer an APY range of 0.44-2.36% for USDC:

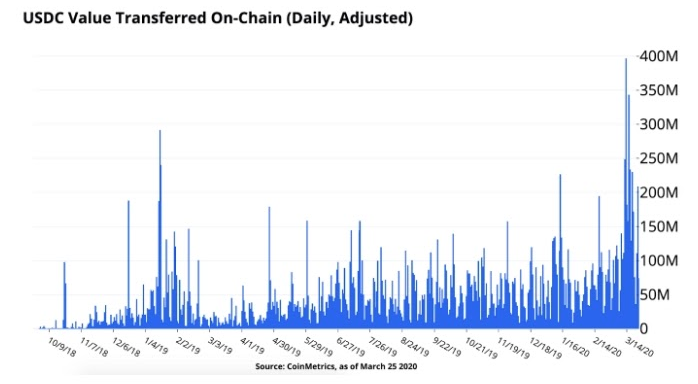

USDC Daily Transferred Value, Market Cap Growing

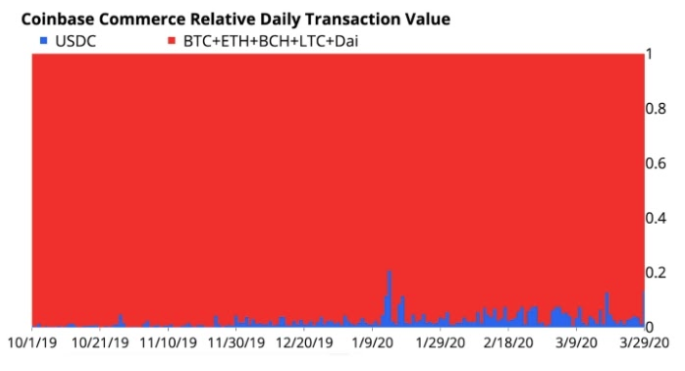

Per the Coinbase Commerce Platform, the demand for USDC grows among the clients. USDC is one of the two stablecoins supported by Coinbase.

During the last three months, the economic activity and the use of USDC slowly gained more of the adoption. It had a usage increase of up to 20% in the days like January 14, 2020. The percentage shows USDC’s share of the total daily transaction volume on the platform.

Coinbase Commerce has a transaction volume worth over $200 million so far.

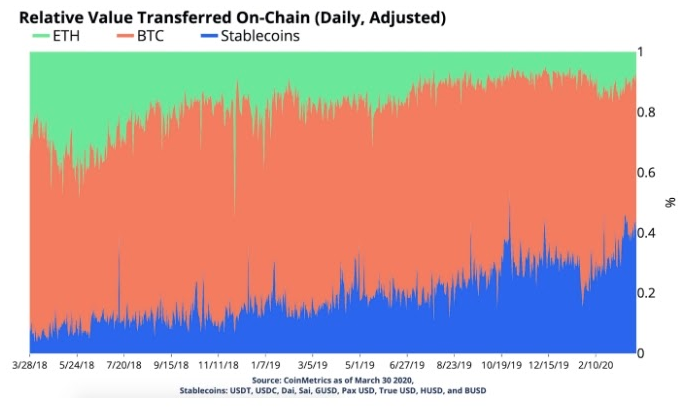

During the past two years, the value of stablecoin systems rose. Stablecoins are in use by more than 40% of all the cryptocurrency transactions:

The usage of Ethereum’s blockchain is diminishing. While Bitcoin looks like it keeps the lion’s share, it is not growing towards eating off the shares of Ethereum and most Stablecoins. But don’t forget that many of the stablecoins, including Tether, work on the ETH blockchain.

Since March 1, the market cap of USDC rose from $457 million to over $700 million. The daily on-chain transfer value of USDC is more than $400 million. After the stablecoin’s inception, it has transferred more than $26 billion. Interestingly, the daily transfer value grows for many other stablecoins too.

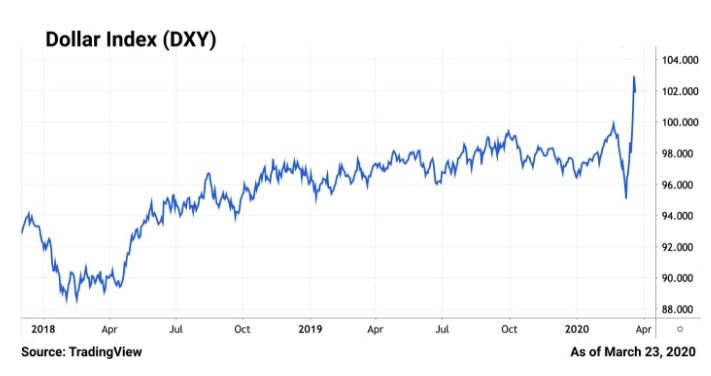

Markets demand a safe haven in the rough times of the world crisis. Investors sell off their stocks to buy gold, silver, food, and cryptocurrencies. If your local currency can lose 5-20% of value in a month, the dollar seems like a good alternative too.

Even developed parts of the world seek for dollars. In a piece ‘The World Desperate for Dollars‘ by The Wall Street Journal’s Chong Koh Ping and Serena Ng, authors write on how countries buy the dollar in 2020 as the hedging asset. The DXY index is measuring the U.S. dollar against the Euro, Pound, and Yen. It did a sharp increase at the end of March 2020:

Stablecoin: a Global Savior, Or a Crying Princess?

Stablecoins allow cross-border, instant, KYC-free transactions. When you create a crypto wallet, it takes minutes. When you create a bank account, it could take hours. Stablecoins could be one of the keys to global crypto adoption. However, the crypto market is not heavily regulated today.

The piece by Coinbase analyst features a quote from the Bank of International Settlements (BIS). The Bank claims retail stablecoins could serve as a global business gateway:

“In principle, retail stablecoins could enable a wide range of payments and serve as a gateway to other financial services. In doing so, they could replicate the role of transaction accounts, which are a stepping stone to broader financial inclusion.”

DISCLAIMER

The views expressed in the article are wholly those of the author and do not represent those of, nor should they be attributed to, ZyCrypto. This article is not meant to give financial advice. Please carry out your own research before investing in any of the various cryptocurrencies available.

The original article written by Jeff Fawkes and posted on ZyCrypto.com.

Article reposted on Markethive by Jeffrey Sloe

Visit MarketHive to learn more: http://markethive.com/jeffreysloe