Here’s How Crypto Whales Are Playing the Bitcoin Correction

Here’s How Crypto Whales Are Playing the Bitcoin Correction, According to On-Chain Analyst

By Daily Hodl Staff • April 26, 2021 // BITCOIN

A pseudonymous on-chain analyst and market cyclist is exposing the behavior of old and new whales amid the continued Bitcoin correction.

In the new tweetstorm, the analyst known as Dilution-proof highlights a certain group of whales who he believes is responsible for igniting the big Bitcoin sell-off from its all-time high of about $64,000.

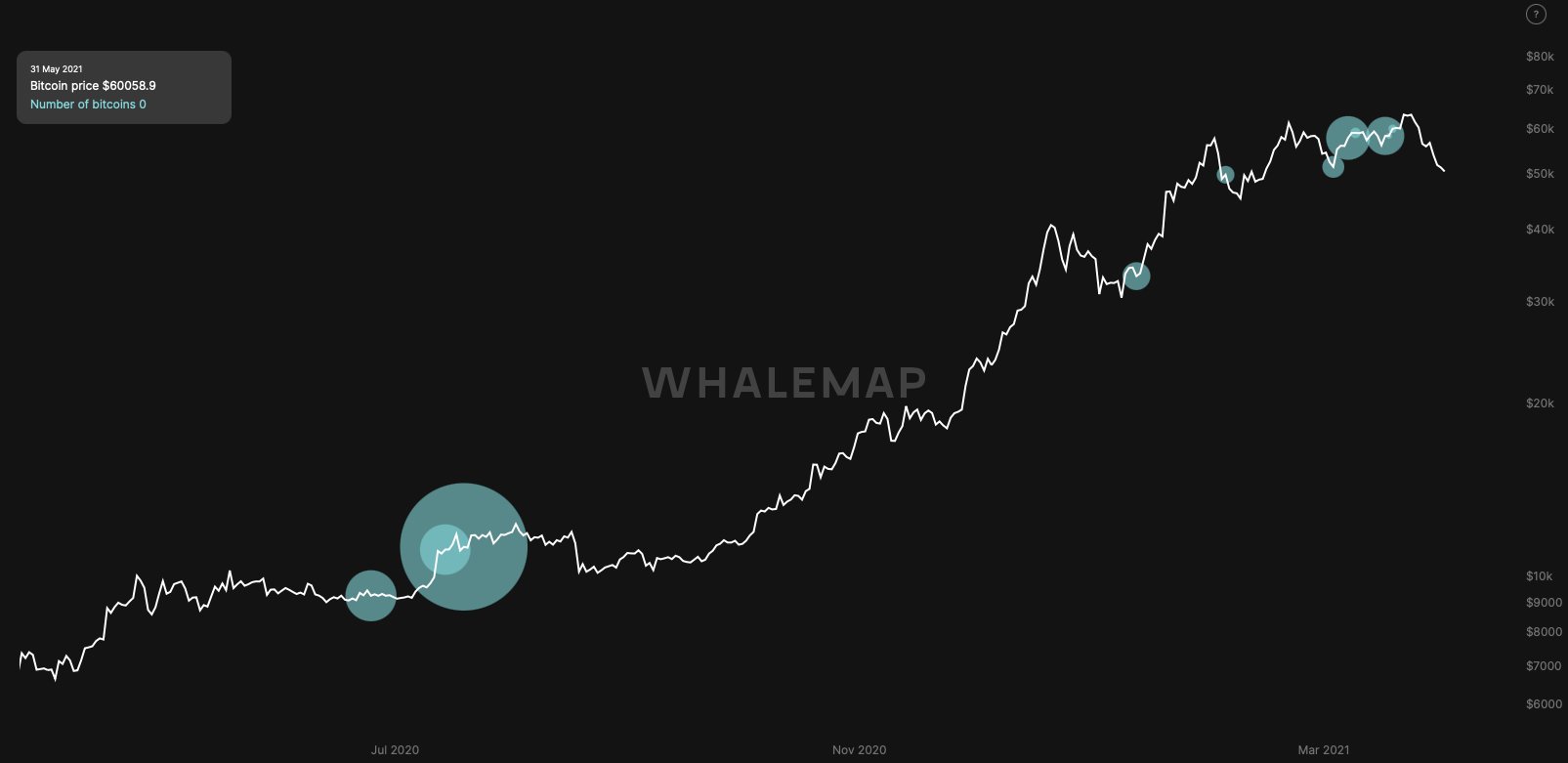

“The market turnaround started last Sunday (April 18th), when price broke through $60,000 with increased volume. As can be seen in this whale outflows chart, a lot of Bitcoin moved that day that was bought by whales on August 3rd, 2020 for ~$11,000.”

Source: Dilution-proof/Twitter (Click image for larger view)

According to Dilution-proof, whales who bought BTC around $10,000-$11,000 last year saw the move above $60,000 as a chance to take profits and lock in gains of about 445%.

As Bitcoin’s upward momentum lost steam, the on-chain analyst says that whales who bought BTC when it broke out of $20,000 in December 2020 took the chance to take profits.

“On Thursday (April 22nd), price also broke down the ~$1 trillion market cap price. On that day, a lot of whale-owned Bitcoin that were bought on December 22nd, 2020, for ~$23,800 moved. Looks again like >100% profit-taking. This time by a slightly newer market participant.”

Source: Dilution-proof/Twitter (Click image for larger view)

As the corrective move intensified, pushing Bitcoin below $50,000, Dilution-proof says that a new breed of whales succumbed to BTC’s downward spiral.

“The Bitcoin price also broke through $50,000 in what felt like a mini-capitulation event. Zooming in on whale movements again, this time there was a lot less action – only some by one-month-old whales that bought around $60,000 and apparently accepted a ~20% loss.”

Source: Dilution-proof/Twitter (Click image for larger view)

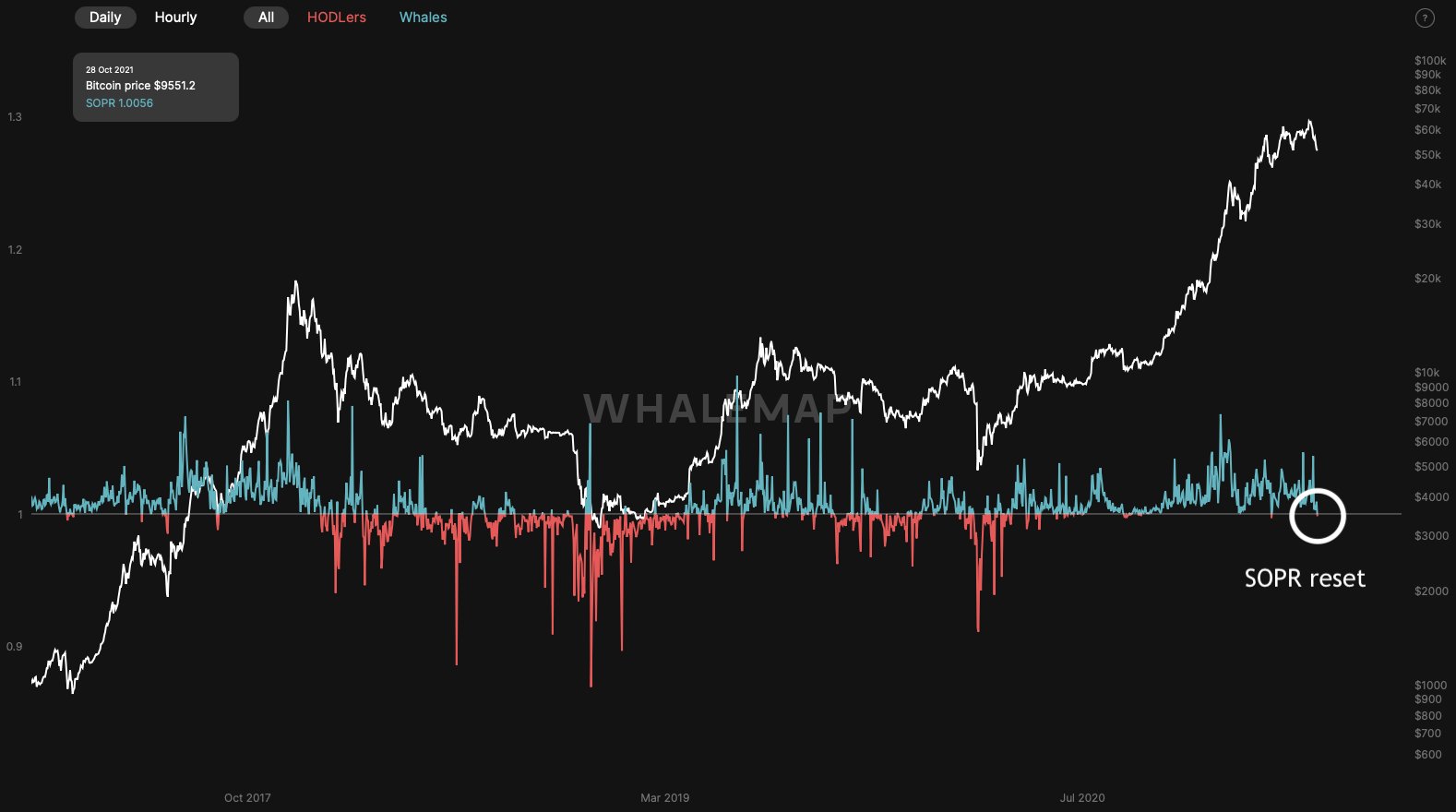

Dilution-proof adds that the Spent Output Profit Ratio (SOPR), which calculates the net profit or loss of market participants, is at a level where Bitcoin may start carving out a bottom.

“This dip started with older whales taking profit, creating a cascading effect of profit-taking all the way to capitulation by newbie whales. The good news: the Spent Output Profit Ratio (SOPR) has completely reset, which means that profit-taking is now neutral (which is bullish).”

Source: Dilution-proof/Twitter (Click image for larger view)

Dilution-proof also highlights that new whales have entered the BTC market in the last few months, creating a new base of buyers where Bitcoin could stage the next phase of its bull rally.

“The price action over the past week has created new clusters of large whale addresses with a fresh new realized price and profit status that may be the whale HODL’ers of the next leg up – and/or beyond.”

The original article written by Daily Hodl Staff and posted on DailyHodl.com.

Article reposted on Markethive by Jeffrey Sloe