Investors Will Wake Up to Bitcoin at 1 Trillion Market Cap: Macro Investor

Investors Will Wake Up to Bitcoin at $1 Trillion Market Cap: Macro Investor

What Will Draw Investors to Bitcoin?

For the most part, investors abiding by traditional investment strategies have avoided Bitcoin like the plague. Legendary investor Warren Buffett, for instance, once called the cryptocurrency “rat poison squared”, later explaining that there isn’t much inherent value in the project. Other notable players in finance and politics, including U.S. President Donald Trump, have echoed this analysis, using phrases like “thin air” and “unbacked” to get their point across.

Unlike traditional stocks and assets, Bitcoin doesn’t provide a fixed yield, a dividend, or generate cash flow. And compared to traditional and modern fiat currencies, BTC isn’t backed by the power of a government or the scarcity of an underlying asset. The foreign elements of the cryptocurrency have thus led most traditional investors to cast it aside.

However, analysts are saying that investors may begin to flock to Bitcoin — if one requirement is fulfilled that is.

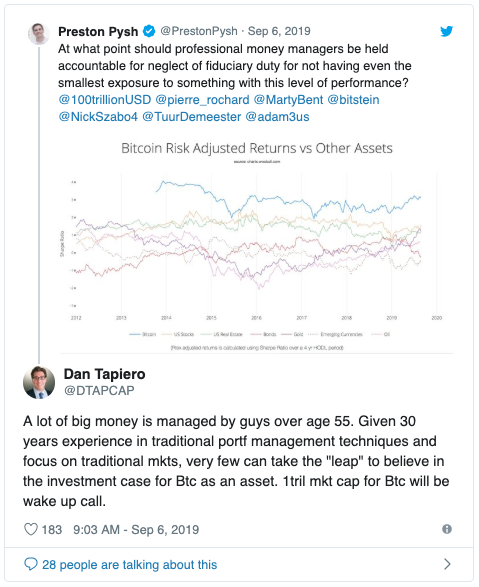

In a recent tweet, Dan Tepiero, the founder of investment fund DTAP Capital and co-founder of Gold Bullion International, argued that there is one thing that will drive investors to Bitcoin: a market capitalization of over $1 trillion, which BTC is still around 400% away from.

He wrote that if you boil down the demographics of the world’s largest money managers, you get “guys over 55”, most of whom he claims “can take the ‘leap’ to believe in the investment case for BTC as an asset”. But, once the cryptocurrency reaches the $1 trillion milestone, it may awake something in investors.

For those unaware, Tapiero is a global macro investor and hard money advocate that believes Bitcoin is seriously undervalued — being a secure network that can reach anyone with an internet connection. The investor made his case for the cryptocurrency in an interview with Real Vision, a finance media outlet run by some of the world’s largest fund managers and investors:

While a $1 trillion valuation for the world’s first cryptocurrency seems quite lofty, it may not be that far away. Twitter analyst PlanB’s seminal price model for Bitcoin, the stock-to-flow (SF) ratio model, has shown that after the May 2020 block reward halving, BTC’s fair market capitalization will swell to $1 trillion. This translates to $50,000 per coin.

Why BTC?

So, what will draw investors to Bitcoin?

Well, to be frank, the first and foremost factor in getting traditional investors to allocate capital to this space is pure FOMO. We already saw this on a relatively small scale in 2017.

But also important is the fact that the leading cryptocurrency provides benefits in traditional portfolios. Delphi Digital, a crypto research outfit, found in late-2020 that “using a simple tiered-allocation analysis,” a portfolio that is made up of 57% stocks, 40% bonds, and 3% Bitcoin yielded the highest Sharpe Ratio (a popular measure of a portfolio’s risk-return potential).

Original article posted on the EthereumWorldNews.com site, by Nick Chong.

Article re-posted on Markethive by Jeffrey Sloe

Visit MarketHive to learn more: http://markethive.com/jeffreysloe